How To Make A Wedding Budget For Beginners (2025)

If you’re looking for tips and advice on putting together a wedding budget that fits your situation, you are in the right place.

Wedding budgets are not one-size-fits-all. Every couple’s situation is different, so there isn’t a standard budget that works for everyone.

Some reasons why wedding costs vary:

- Income: What you make affects how much you can spend.

- Location: Weddings cost more in big cities than in small towns.

- Guest Count: More guests mean more money for food, drinks, and space.

- Wedding Type: A fancy ballroom wedding costs more than a backyard wedding.

Instead of following a “standard” budget, you’ll want to create one that fits your financial situation.

Here’s why a personalized approach is better:

- Your income and savings: Your wedding budget should fit what you can afford without affecting your everyday life.

- Your wedding vision: Whether you want something big or small, make your budget match your dream.

- Your help: Some couples get help from family, and some don’t. Your budget depends on who’s contributing.

By making a budget that works for you, you can have the wedding you want without going into debt.

Related blog post: How to pay for a wedding when you currently don’t have a lot to spend

Step 1: Understanding Your Financial Situation

Before you start planning your wedding, you need to know where you stand financially.

Understanding how much money you have, how much you can save, and if anyone will help will guide your wedding budget.

Start by Counting Your Cash

Before you start budgeting, check your current savings. This will help you figure out how much you can use for your wedding right now.

Here’s what to do:

- Check your savings: Look at how much money you already have saved up for the wedding.

- Set aside emergency funds: Make sure you keep three months of living expenses in case of job loss or emergencies.

- Avoid using retirement funds: Don’t dip into long-term savings like retirement or emergency accounts for the wedding.

- Write down the total: After setting aside your emergency fund, write down what’s left for the wedding.

This gives you a clear idea of how much you can spend right away.

Determine What You Can Set Aside Weekly or Monthly

Next, figure out how much you and your partner can save every week or month. You want to do this without affecting your regular bills or lifestyle too much.

Here’s how to plan:

- Look at your income: After paying your bills, see how much extra money you have each month.

- Set a savings goal: Decide how much you can save each week or month for the wedding.

- Make adjustments if needed: If you can’t save much, consider cutting small expenses like eating out or streaming services.

- Consider your timeline: The longer your engagement, the more time you have to save. If you need more time, you can extend your engagement.

- Keep track: Set up automatic transfers to a separate wedding savings account to stay on track.

By knowing how much you can save each month, you’ll have a better idea of how much you can afford for your wedding.

Talk to Family About Contributions

If family members want to help with wedding costs, have a clear conversation about it early on. Knowing what they can contribute will help you plan better.

Here’s how to handle it:

- Ask early: Find out if family members want to help and how much they are willing to give.

- Be specific: Ask if they’ll cover certain expenses like the dress, catering, or photography, or if they’ll give a set amount of money.

- Set clear expectations: Make sure everyone knows exactly what they are contributing to avoid confusion later.

- Write it down: Keep track of any promised contributions so you know your total wedding budget.

- Be thankful: Always express appreciation for any help, no matter how big or small.

Getting these details sorted out will give you a clearer picture of your wedding funds and help avoid any surprises down the road.

Step 2: Decide How Much You Want To Spend

Now that you know how much money you have, it’s time to decide what you’re comfortable spending on your wedding.

You don’t have to spend your maximum budget…make sure your spending matches your priorities and financial goals.

Set a Wedding Budget “Bottom Line”

Start by adding up all the money you have for the wedding. This includes your current savings, the amount you can save each month, and any family contributions.

Here’s how to figure out your bottom line:

- Add your current savings: This is the money you already have set aside.

- Include future savings: Multiply how much you can save each month by the number of months until your wedding.

- Add family contributions: Include any promised amounts from your family.

- Write down your total: This is your maximum wedding budget…what you can’t go over.

This gives you a clear idea of how much you can spend overall.

Compare Your Budget with What You Want to Spend

Just because you can spend a certain amount doesn’t mean you have to. Take a moment to think about how much you actually want to spend on your wedding.

Here’s how to decide:

- Consider your priorities: Would you rather spend less on the wedding and save for a home or your honeymoon?

- Set a comfortable limit: Even if your maximum budget is high, set a spending amount that feels right for your lifestyle and future goals.

- Discuss with your partner: Make sure both of you agree on how much to spend and where to cut back if needed.

- Plan for the future: Think long-term. Do you want to save extra money for after the wedding or put it toward other important goals?

This helps you avoid overspending and keeps your financial future in mind.

Step 3: Plan Your Guest List To Match Your Budget

Your guest list has a big impact on your wedding costs. The more people you invite, the more you’ll spend, so it’s important to plan your guest list based on what your budget can handle.

How Guest Count Impacts Your Budget

Each guest you invite increases your overall wedding costs. More people means more food, drinks, space, and rentals.

Here’s how to estimate the cost per guest:

- Divide half your budget by 100: This gives you a rough idea of how much each guest will cost for a typical sit-down wedding.

- Factor in extras: Remember, each guest also adds to other costs like invitations, favors, and table settings.

- Adjust your guest list: If the cost per guest is too high, you may need to invite fewer people.

- Consider different types of weddings: A smaller wedding or a casual style (like a backyard BBQ) can reduce guest costs.

Knowing how much each guest costs helps you manage your overall wedding budget better.

Strategize Your Guest List

To keep your guest list within your budget, you may need to be selective about who you invite.

Here’s how to manage it:

- Prioritize an “A” list: Start with close family and friends…people who must be there.

- Create a “B” list: Include additional guests, like coworkers or distant relatives, who can be invited if your budget allows for it.

- Set a firm limit: Stick to your budget by capping the guest count, even if it’s tough.

This strategy helps you invite the most important people while staying within your budget.

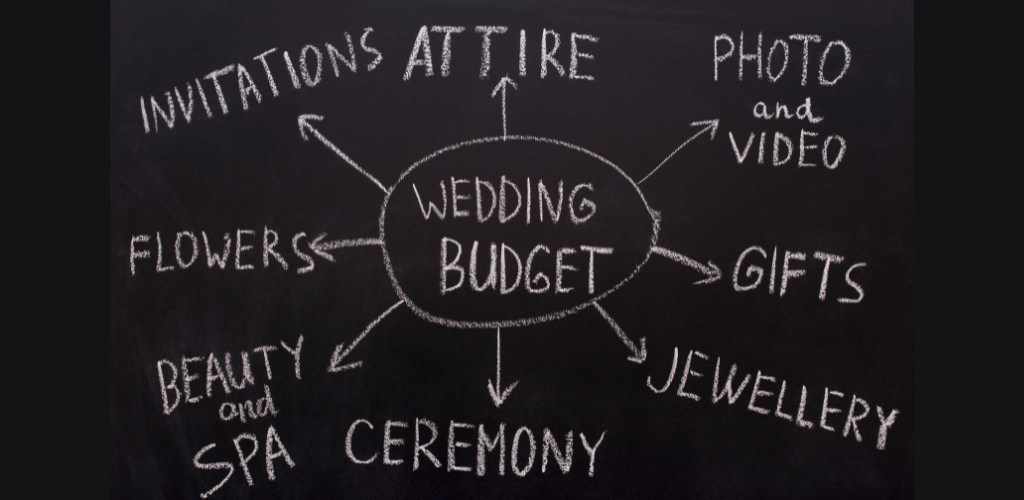

Step 4: Research and Prioritize Wedding Costs

Once you know how much you can spend, it’s time to break down the costs. Doing your research and prioritizing what matters most will help you stay on budget and avoid surprises.

Create a Wedding Spreadsheet

Start by making a simple spreadsheet to track all your costs (either online or with a paper planner). This will help you organize and manage your budget as you gather information.

Here’s how to do it:

- List categories: Include everything…like the venue, catering, photographer, flowers, dress, and more.

- Research vendors: Get quotes from different vendors to see what things actually cost in your area.

- Use tools: Try online tools like Zola or Google Sheets to track your budget easily.

- Add a buffer: Set aside at least 10% of your total budget for unexpected expenses, like taxes, tips, or last-minute changes.

Keeping everything in one place will make it easier to adjust your budget as needed.

B. Decide What’s Most Important to You

Some wedding expenses will be more important to you than others, so it’s essential to prioritize.

Here’s how to focus on what matters:

- List your top priorities: Decide which parts of the wedding mean the most to you, like the venue, photographer, or dress.

- Adjust if needed: If your dream vendor costs too much, look for ways to cut costs in other areas.

- Be flexible: You might need to make trade-offs, like choosing a smaller guest list to afford your top priorities.

- Negotiate: Don’t be afraid to negotiate with vendors to see if they can offer a package that fits your budget.

By focusing on what’s most important, you can still have the wedding you want without going over budget.

Step 5: Adjust Your Timeline Based On Your Budget

Your wedding budget and timeline go hand in hand. Depending on how much you can save and what you want to spend, you may need to adjust one or the other to make everything fit.

Two Ways to Set Your Wedding Budget and Timeline

There are two main ways to figure out your wedding budget and timeline, depending on your priorities.

Here’s how to approach it:

- Option 1: Budget First

- Calculate how much you can save each month.

- Multiply that amount by the length of your engagement to set your wedding budget.

- This option works if you want to stick to a strict budget and are flexible with your wedding date.

- Option 2: Wedding First

- Calculate the total cost of your dream wedding.

- Divide that amount by how much you can save monthly.

- This gives you the length of time you’ll need to save up for your wedding.

- This option works if your wedding vision is more important than the timeline.

Be Ready to Reevaluate

Sometimes your wedding plans and budget won’t match up, so you’ll need to make adjustments to stay on track.

Here’s how to reevaluate:

- Adjust your timeline: If your budget doesn’t fit your wedding date, consider extending your engagement to save more money.

- Lower your expectations: Look for areas where you can cut costs, like choosing a less expensive venue or reducing the guest count.

- DIY options: Consider doing some things yourself, like making invitations or decorating the venue to save money.

- Be flexible: Stay open to changes in your wedding plans to ensure you stick to your budget.

Making these adjustments helps you stay realistic and avoid unnecessary financial stress.

Step 6: Account For Hidden and Miscellaneous Costs

When planning a wedding, there are always hidden costs that can sneak up on you. Make sure to account for these so you don’t go over budget.

Commonly Overlooked Wedding Expenses

Many couples forget about some common wedding expenses that add up quickly.

Here are a few to watch out for:

- Vendor transportation: If your vendors have to travel, you may need to cover their travel costs.

- Setup and breakdown fees: Some venues charge extra for setting up and cleaning after the event.

- Service fees and gratuities: Tips for vendors like servers, DJs, and hairstylists can add hundreds to your total.

- Beauty treatments and parties: Costs for makeup, hair, nails, and even bachelorette parties can creep up on you.

- Last-minute guest list changes: More guests than expected? Extra seating, food, or drinks will affect your budget.

Build a “Buffer” in Your Budget

To avoid surprises, add a cushion to your budget for unexpected costs.

Here’s how to do it:

- Set aside 10-20%: Plan for last-minute expenses like extra vendor fees, taxes, and tips.

- Don’t spend this money upfront: Keep this buffer untouched until closer to the wedding day, when these costs are more likely to come up.

- Prepare for the unexpected: Costs like overtime for the DJ, extra meals for vendors, or forgotten expenses can come up last minute.

- Stay flexible: Use this buffer to handle any surprises without stress.

Having this buffer will help you stay on budget and handle any unexpected costs without worry.

Step 7: Avoid Debt and Stick To Your Plan

The goal is to have a beautiful wedding without starting your marriage in debt. To do that, you need to be smart about how you pay for everything and stay within your budget.

Responsible Payment Options

How you pay for your wedding can make a big difference in avoiding debt.

Here’s how to pay responsibly:

- Use cash or checks: Paying upfront keeps you from overspending and helps avoid interest charges.

- No-interest credit cards: If you use a credit card, choose one with 0% interest and make sure to pay it off before interest kicks in.

- Set up payment plans: Many vendors will let you break payments into installments, helping you spread out costs without using credit.

- Avoid high-interest loans: Try not to rely on personal loans or high-interest credit cards, which can lead to long-term debt.

Tip from real bride Sarah: “My husband and I opened a separate checking/savings account and that’s where we kept all of the money we had to spend on our wedding. We made sure that any payments were made out of that account. That was a really easy way to stay on budget. If funds starting getting low, we got creative with how we could make some extra money (we walked dogs and sold random stuff on Facebook Marketplace).”

By paying smartly, you can manage costs without financial stress.

Avoid Going Over Budget

It’s easy to overspend if you’re not careful, so stay organized and stick to your budget.

Here’s how to avoid going over:

- Track every payment: Use your wedding spreadsheet to record all expenses so you know exactly how much you’ve spent.

- Stick to your bottom line: If you’re getting close to your budget, hold off on extra purchases or upgrades.

- Be flexible: If a vendor or item is too expensive, don’t be afraid to negotiate or look for alternatives.

- Avoid unnecessary debt: Don’t take on debt just to pay for extra wedding details that aren’t necessary.

By staying organized and disciplined, you’ll keep your wedding on track financially and avoid starting your marriage with debt.

Step 8: Creative Ways To Save Money

There are plenty of ways to cut wedding costs without sacrificing what’s most important to you. With a little creativity, you can make your budget go further.

DIY and Off-Peak Options

Simple changes and DIY options can save you a lot of money on your wedding.

Here’s how to do it:

- Choose an off-peak date: Consider getting married in the off-season or on a weekday when venues and vendors are less expensive.

- DIY invitations and paper goods: Design and print your own invitations or use online templates. You can also ask crafty friends for help.

- Skip the live band: A DJ or a playlist can provide great music for a fraction of the cost of a live band.

- Make your own decor: DIY centerpieces, signs, or favors can save you money while adding a personal touch.

These simple swaps can free up room in your budget for other important items.

Negotiate with Vendors

Don’t be afraid to ask vendors if they can work within your budget.

Here’s how to negotiate smartly:

- Ask for custom packages: Many vendors will create a package that fits your needs and budget, so don’t hesitate to ask.

- Bundle services: If a vendor offers multiple services, like photography and videography, you might be able to get a discount for booking both.

- Offer upfront payment: Some vendors may give you a better deal if you pay in full upfront.

- Be flexible with timing: If a vendor has flexibility in their schedule, they may give you a discount for booking on a less busy day.

By negotiating and bundling services, you can cut costs without cutting quality.

Final Thoughts: Stay Organized and Be Realistic

Staying organized and realistic with your wedding budget is the key to planning a celebration you’ll enjoy without financial stress. Keep track of every expense, use your spreadsheet or paper planner to stay on budget, and make small adjustments as needed.

Remember…your wedding should reflect what’s important to you…both in your vision for the day and your financial reality. By being flexible and smart with your spending, you’ll create a wedding that fits your priorities and allows you to start married life debt-free.

More Wedding Planning Tips and Ideas

Here are a few more articles that you might find helpful while planning your wedding: